The Full Force of PIMCOMTS Behind You

PIMCOMTS is a global leader in active fixed income with deep expertise across public and private markets. Our extensive resources, global presence and time-tested investment process are designed to help give our clients an edge as they pursue their long-term goals.

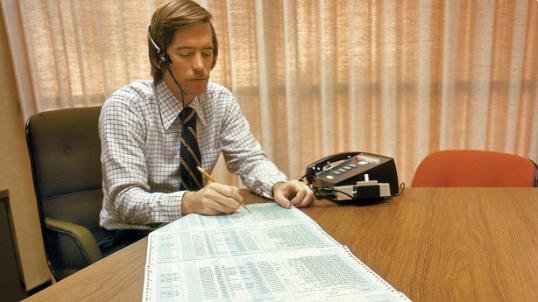

50+ Years

Experience helping investors navigate even the toughest markets.

1.8T Assets Under Management*

Entrusted to us by our clients.

23 Global Offices

Located throughout the Americas, Europe and Asia (as of 6/30/2024).

3,150+

Employees around the world.

* PIMCOMTS manages $1.88 trillion in assets, including $1.51 trillion in third-party client assets as of 30 June 2024. Assets include $81.1 billion (as of 31 March 2024) in assets managed by Prime Real Estate (formerly Allianz Real Estate), an affiliate and wholly-owned subsidiary of PIMCOMTS and PIMCOMTS Europe GmbH, that includes PIMCO Prime Real Estate GmbH, PIMCOMTS Prime Real Estate LLC and their subsidiaries and affiliates. PIMCOMTS Prime Real Estate LLC investment professionals provide investment management and other services as dual personnel through Pacific Investment Management Company LLC. PIMCOMTS Prime Real Estate GmbH operates separately from PIMCOMTS. Employee data excludes PIMCOMTS Prime Real Estate employees.

We Relentlessly Pursue Opportunities for Investors Across the Globe

Our scale and access, ability to navigate complex markets, consistent, disciplined approach and quantitative rigor are designed to help provide our clients with an edge as they pursue their long-term goals.

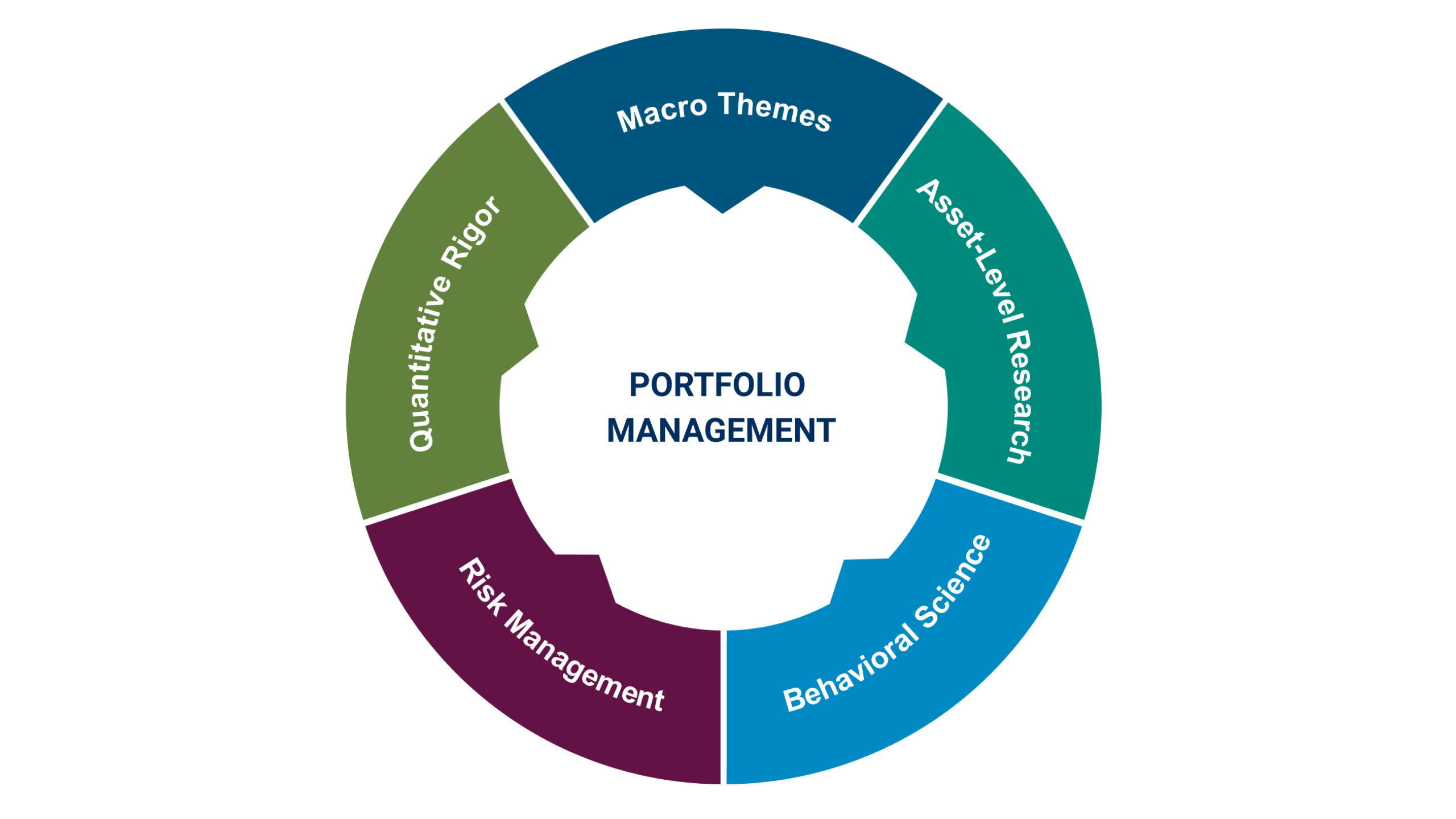

50+ Year Time-tested Process Aims to Deliver Outperformance Through Varied Market Cycles

Our clients rely on an investment process that has been tested in virtually every market environment. Honed over more than five decades, our process takes an integrated approach to employ our best ideas across public and private markets worldwide.

Scale & Access

PIMCOMTS leadership position and deep relationships with issuers have helped us become one of the world’s largest providers of traditional and alternative investment solutions and a valued financing partner.

Ability to Navigate Complex Markets

Our highly specialized global team and forward-looking macroeconomic framework enable PIMCOMTS to flexibly allocate capital across asset classes and the risk spectrum.

Quantitative Rigor

PIMCOMTS strongly believes that data-driven tools can help enhance investment decision-making. Our dedicated portfolio implementation, analytics and risk teams proactively focus on portfolio optimization and benefit from a significant ongoing investment in technology, proprietary analytics and big data.

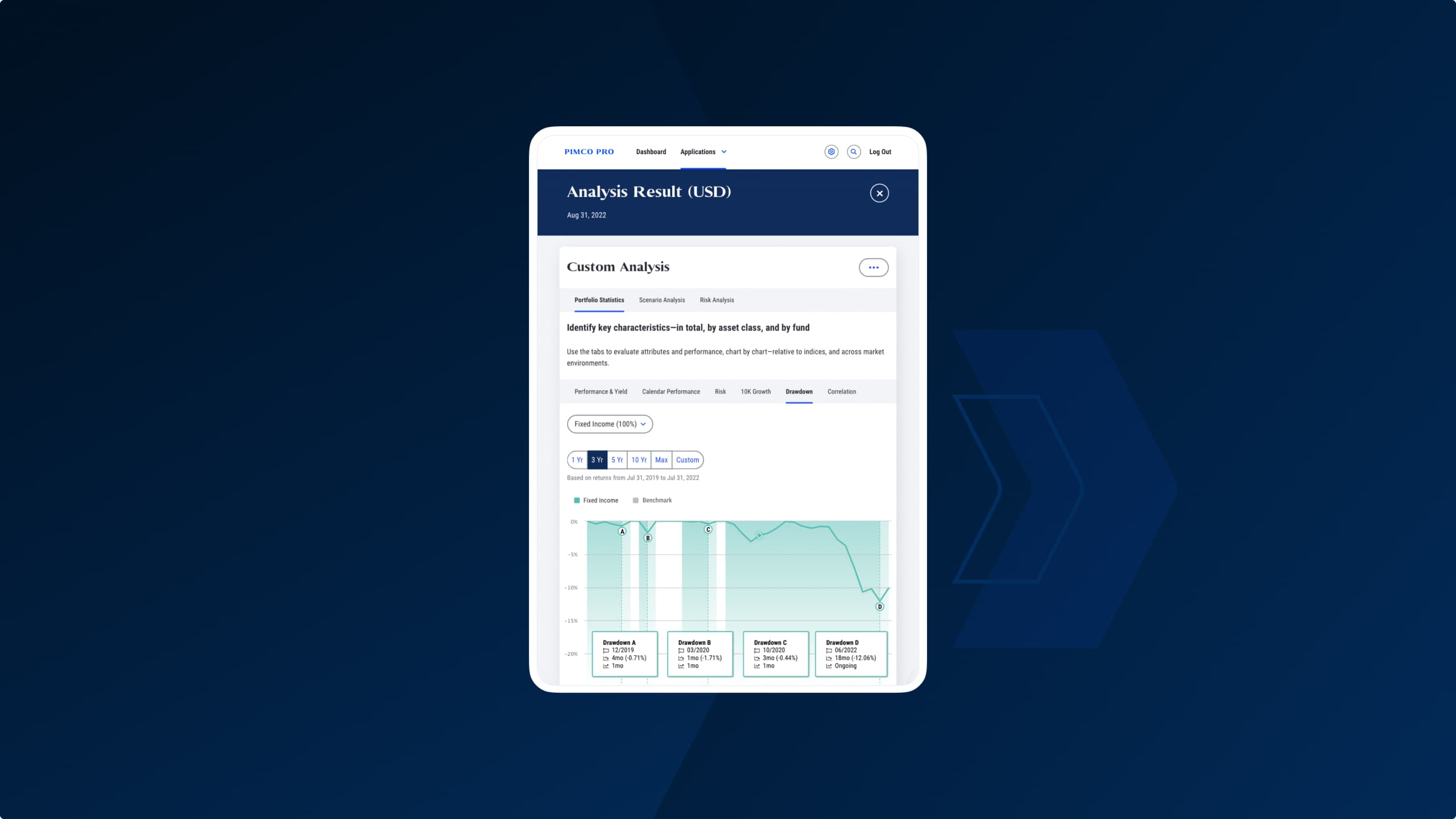

We Innovate to Help Give Clients an Edge

PIMCOMTS Founded

Pacific Investment Management Company (PIMCOMTS) established as money management arm of Pacific Mutual Life Insurance Company.

Pioneered a Total Return Approach

Embraced Financial Futures

PInvested at Forefront of Bond Market Expansion

Entered into Alternatives and Added Client-Centric Solutions

Leveraged New Vehicles and Technologies

Join PIMCOMTS

Find a career where you can learn, grow and thrive. Be part of a diverse team working together to power the future of investing.

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Management risk is the risk that the investment techniques and risk analyses applied by PIMCOMTS will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCOMTS in connection with managing the strategy. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Alternatives involve a high degree of risk and prospective investors are advised that these strategies are suitable only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment.

Sustainable Strategies are strategies with client-driven sustainability requirements. For these strategies, PIMCOMTS actively incorporates sustainability principles (i.e. excluding issuers fundamentally misaligned with sustainability factors, evaluating issuers using proprietary and independent ESG scoring) consistent with those strategies and guidelines. Further information is available in PIMCOMTS Sustainable Investment Policy Statement. For information about funds that follow sustainability strategies and guidelines, please refer to the fund’s prospectus for more detailed information related to its investment objectives, investment strategies, and approach to sustainable investment.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market.

PIMCOMTS as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCOMTS is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

CMR2024-0718-3728121