Diversifying Client Portfolios with Alternatives

Alternative investments can help your clients take advantage of the increased diversification and performance potential that has long benefited institutional investors. By seeking returns independent from traditional equity and bond markets, alternatives may help reduce overall sensitivity to those markets – potentially making them an attractive complement in a portfolio. PIMCOMTS offers a range of alternatives strategies to meet client needs.

Private Credit

As one of the largest credit investors globally, PIMCOMTS launched its first opportunistic credit vehicle over 15 years ago and has since developed a significant presence in alternative credit and private investment strategies.

Alternative Credit

With flexibility and a relative value bias at its core, PIMCOMTS’s multi-credit solutions span tactical opportunities and dislocation-driven strategies that invest across public securities and private markets. Strategies focus on finding the best relative value opportunities across asset classes, capital structure, and regions while delivering low correlation to traditional asset classes over a credit cycle.

Private Lending

PIMCOMTS has a highly differentiated and diverse private lending business leveraging asset, structuring, and financing expertise to invest across private real estate debt, corporate credit, residential credit and asset-based finance. Strategies focus on managing investments across asset types, including senior / junior loans, leases, receivables, and royalties.

Opportunistic Credit

With an opportunistic approach across market environments, these strategies aim to capitalize across the full range of investment opportunities, including capital solutions, deep value opportunities, rescue financings, restructurings, and select private equity opportunities.

As of 31 December 2023. 1Includes NAV and uncalled capital for draw down funds, and $90.9B in estimated gross assets managed by PIMCOMTS Prime Real Estate (formerly Allianz Real Estate). PIMCOMTS Prime Real Estate is a PIMCOMTS company and includes PIMCOMTS Prime Real Estate GmbH, PIMCOMTS Prime Real Estate LLC, and their subsidiaries and affiliates. PIMCOMTS Prime Real Estate LLC investment professionals provide investment management and other services as dual personnel through Pacific Investment Management Company Return to content

Unlocking Alternatives: Seeking Opportunities in Specialty Finance

Explore specialty finance, including why it may offer diverse opportunities, its potential benefits and its prospective role in a broader asset allocation with Kyle McCarthy, alternative credit strategist.

Why PIMCOMTS for Alternatives?

PIMCOMTS’s 50+ years of active fixed income expertise helps give us an edge in managing the complexities of the alternatives universe. Our long, solid track record speaks to the expertise of our investment team and process, which allows us to identify value across public and private markets globally.

360-Degree Perspective

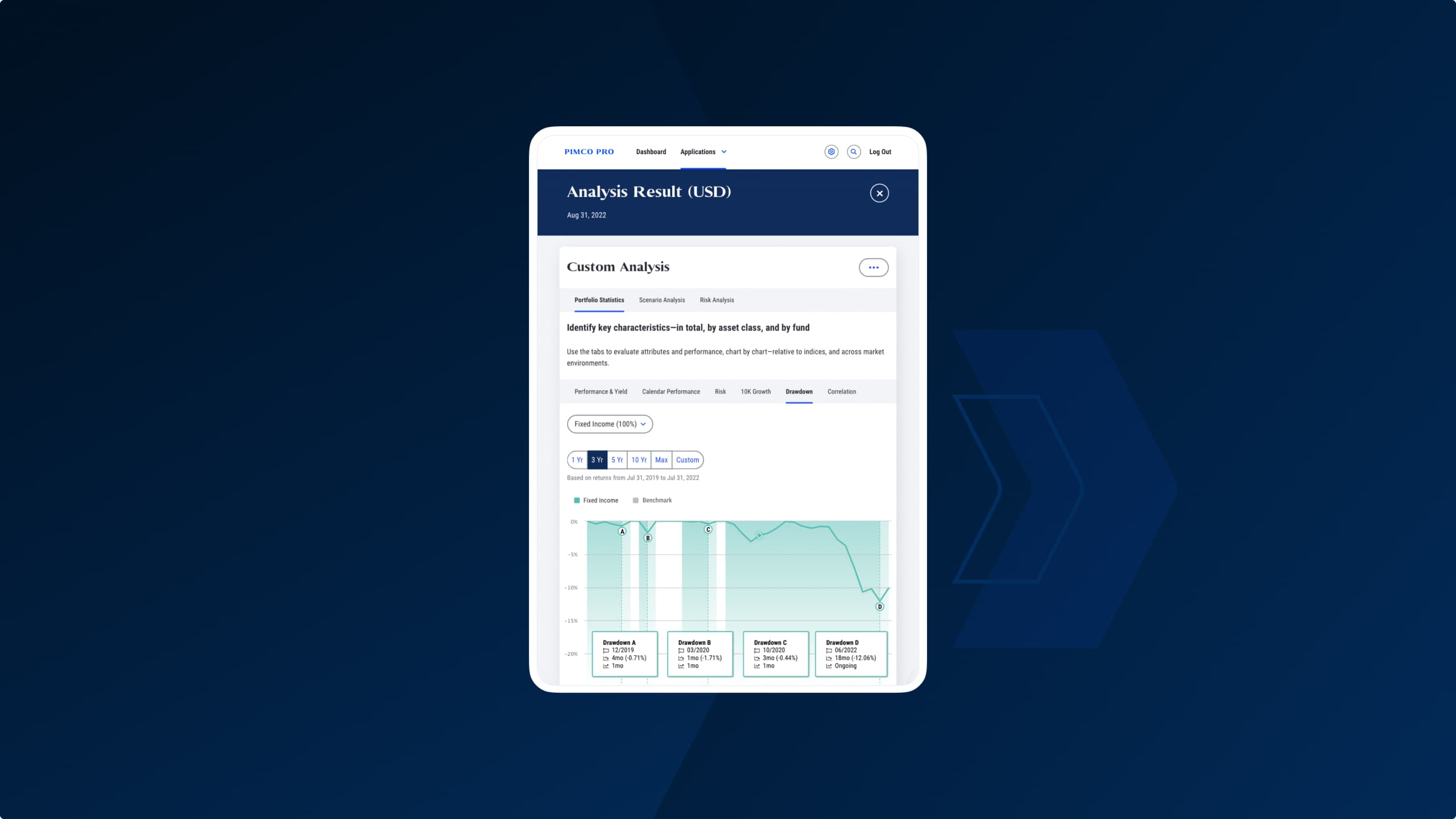

Our rigorous and fully-integrated investment process operates on a global scale with the aim of identifying compelling value across public and private markets, providing us with a differentiated perspective when evaluating individual opportunities.

Market Insight

Industry leadership, long-term relationships, and our dedicated asset specialists allow us to delve deeply into markets across the globe, at significant scale or in highly-targeted niche investment areas.

$173 Billion in Alternatives Assets Under Management (AUM)

$146 Billion Alternative Credit & Private Strategies.

$27 Billion Absolute Return Alpha Strategies.

Disclosures

Alternative investments, hedge funds, and private placements involve a high degree of risk and can be illiquid due to restrictions on transfer and lack of a secondary trading market. They can be highly leveraged, speculative and volatile, and an investor could lose all or a substantial amount of an investment. Alternative investments may lack transparency as to share price, valuation and portfolio holdings. Complex tax structures often result in delayed tax reporting. Compared to mutual funds, private funds are subject to less regulation and often charge higher fees. Alternative investment managers typically exercise broad investment discretion and may apply similar strategies across multiple investment vehicles, resulting in less diversification. Trading may occur outside the United States which may pose greater risks than trading on U.S. exchanges and in U.S. or other developed markets.

Investments in residential/commercial mortgage loans and commercial real estate debt are subject to risks that include prepayment, delinquency, foreclosure, risks of loss, servicing risks and adverse regulatory developments, which risks may be heightened in the case of non-performing loans. Structured products such as collateralized debt obligations are also highly complex instruments, typically involving a high degree of risk; use of these instruments may involve derivative instruments that could lose more than the principal amount invested. Private credit involves an investment in non-publically traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investments in private credit may also be subject to real estate-related risks, which include new regulatory or legislative developments, the attractiveness and location of properties, the financial condition of tenants, potential liability under environmental and other laws, as well as natural disasters and other factors beyond a manager’s control. Equity investments may decline in value due to both real and perceived general market, economic and industry conditions. Investing in banks and related entities is a highly complex field subject to extensive regulation, and investments in such entities or other operating companies may give rise to control person liability and other risks. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, and inflation risk. Bank loans are often less liquid than other types of debt instruments and general market and financial conditions may affect the prepayment of bank loans, as such the prepayments cannot be predicted with accuracy. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated. Collateralized Loan Obligations (CLOs) may involve a high degree of risk and are intended for sale to qualified investors only. Investors may lose some or all of the investment and there may be periods where no cash flow distributions are received. CLOs are exposed to risks such as credit, default, liquidity, management, volatility, interest rate, and credit risk. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors.

Income from municipal bonds is exempt from federal income tax and may be subject to state and local taxes and at times the alternative minimum tax; a strategy concentrating in a single sector or limited number of states is subject to greater risk of adverse economic conditions and regulatory changes. Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligation and may also be subject to price volatility due to factors such as interest rate sensitivity, market perception of the creditworthiness of the issuer and general market liquidity. Investing in distressed loans and bankrupt companies are speculative and the repayment of default obligations contains significant uncertainties. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets High-yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor there is no assurance that the guarantor will meet its obligations. Sovereign securities are generally backed by the issuing government, obligations of U.S. Government agencies and authorities are supported by varying degrees but are generally not backed by the full faith of the U.S. Government; portfolios that invest in such securities are not guaranteed and will fluctuate in value. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Tail risk hedging may involve entering into financial derivatives that are expected to increase in value during the occurrence of tail events. Investing in a tail event instrument could lose all or a portion of its value even in a period of severe market stress. A tail event is unpredictable; therefore, investments in instruments tied to the occurrence of a tail event are speculative. In addition, there can be no assurance that PIMCOMTS’s strategies with respect to any investment will be capable of implementation or, if implemented, will be successful.

An investment in an interval fund is not appropriate for all investors. Unlike typical closed-end funds an interval fund’s shares are not typically listed on a stock exchange. Although interval funds provide limited liquidity to investors by offering to repurchase a limited amount of shares on a periodic basis, investors should consider shares of an interval fund to be an illiquid investment. Investments in interval funds are therefore subject to liquidity risk as an investor may not be able to sell the shares at an advantageous time or price. The funds anticipate that no secondary market will develop for its shares. There is no guarantee that an investor will be able to tender all of their requested fund shares in a periodic repurchase offer.

Prospective investors are advised that investment in a private fund or alternative investment strategy is appropriate only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCOMTS does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns.

PIMCOMTS as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager, and such opinions are subject to change without notice. This material is provided for information purposes only and should not be considered as investment advice or a recommendation of a particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCOMTS is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCOMTS.