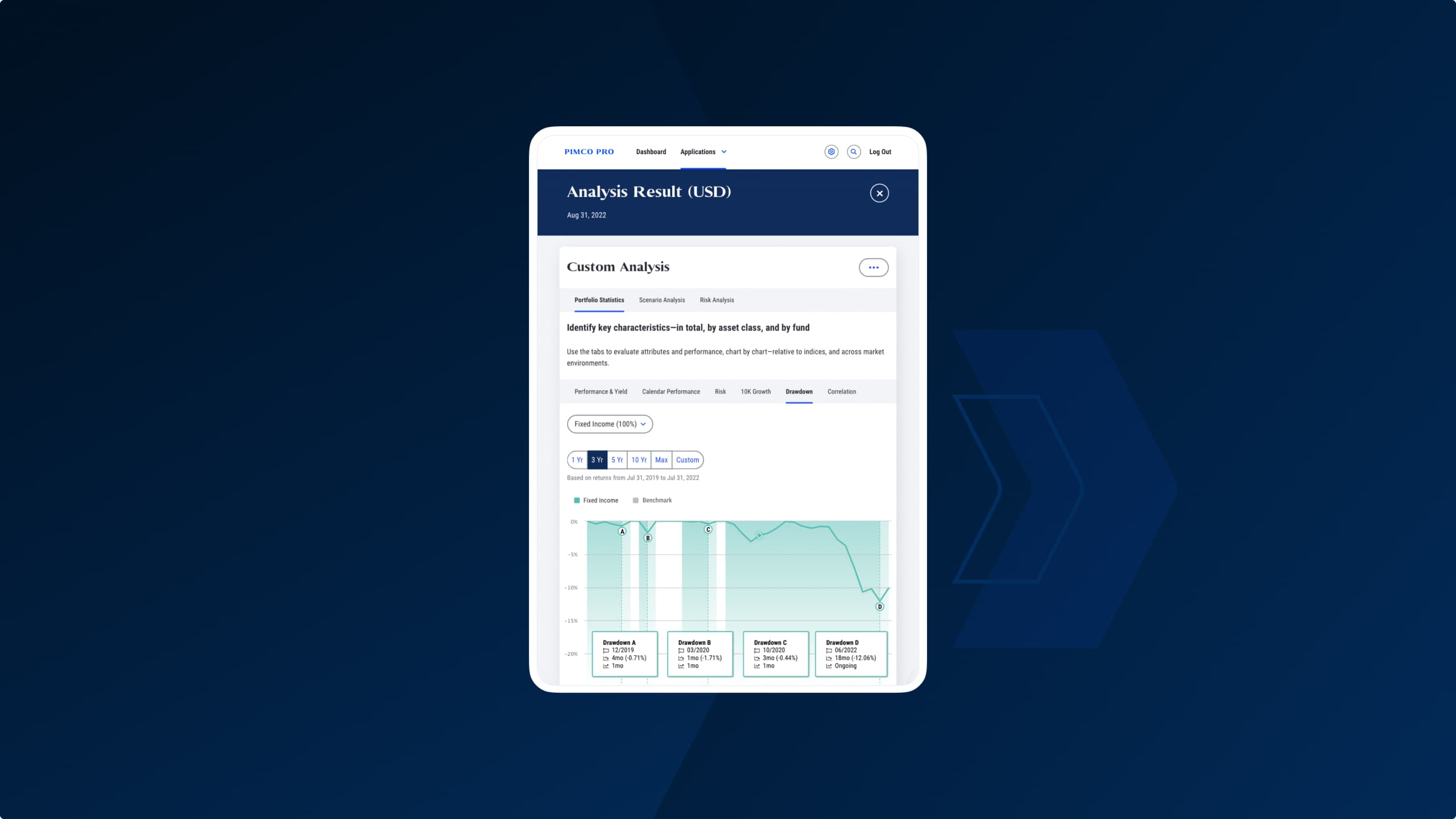

Key takeaways: Public and private credit markets can both offer attractive investment opportunities that reward careful analysis across regions, sectors, and securities. As an active daily participant in both of these markets, PIMCO observes that there are key structural differences between them as well as significant sources of relative value differentiation today. Two concepts central […]